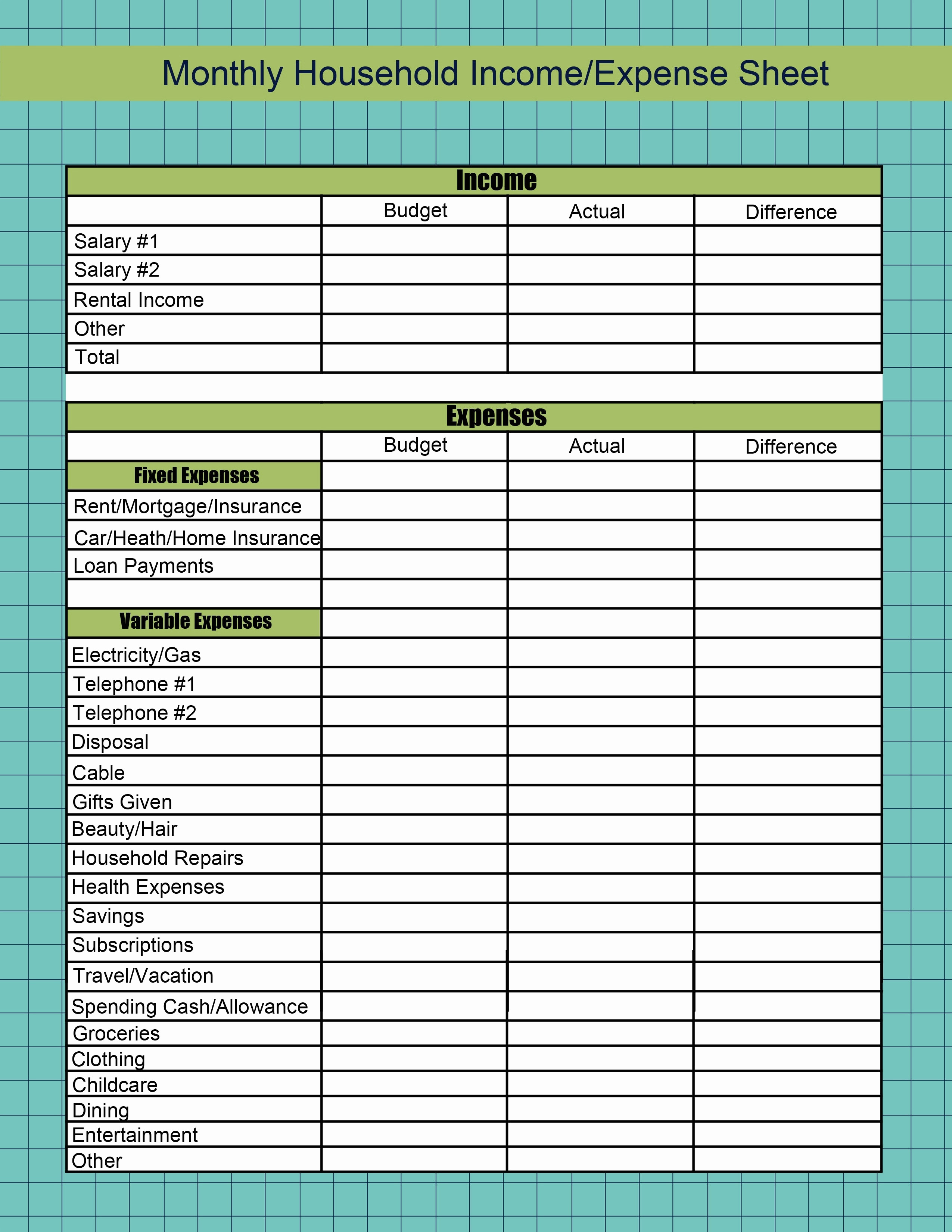

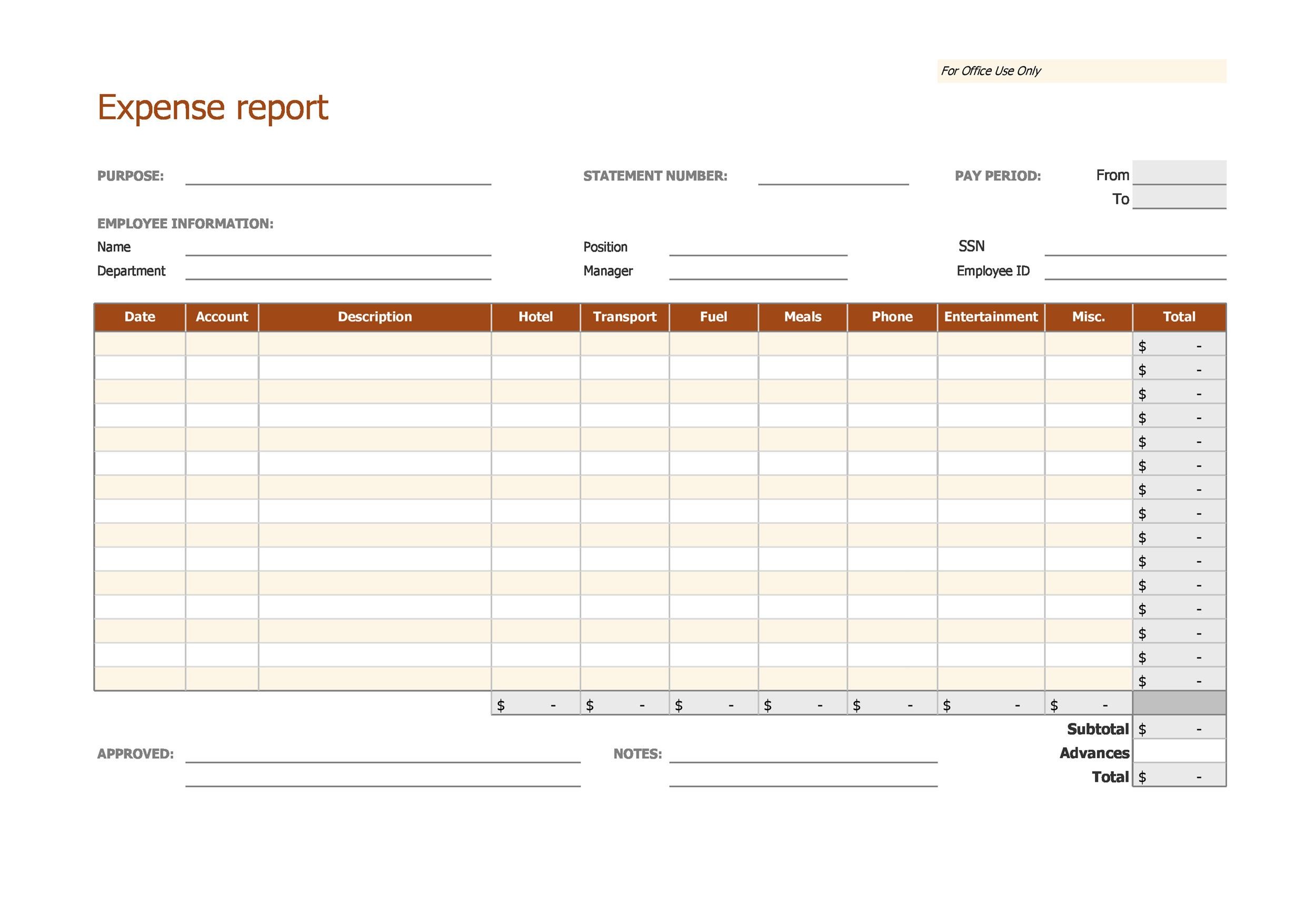

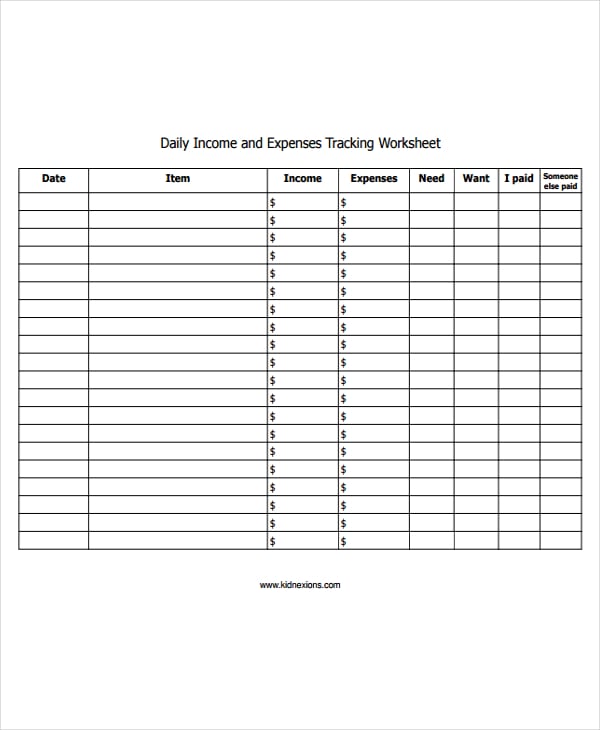

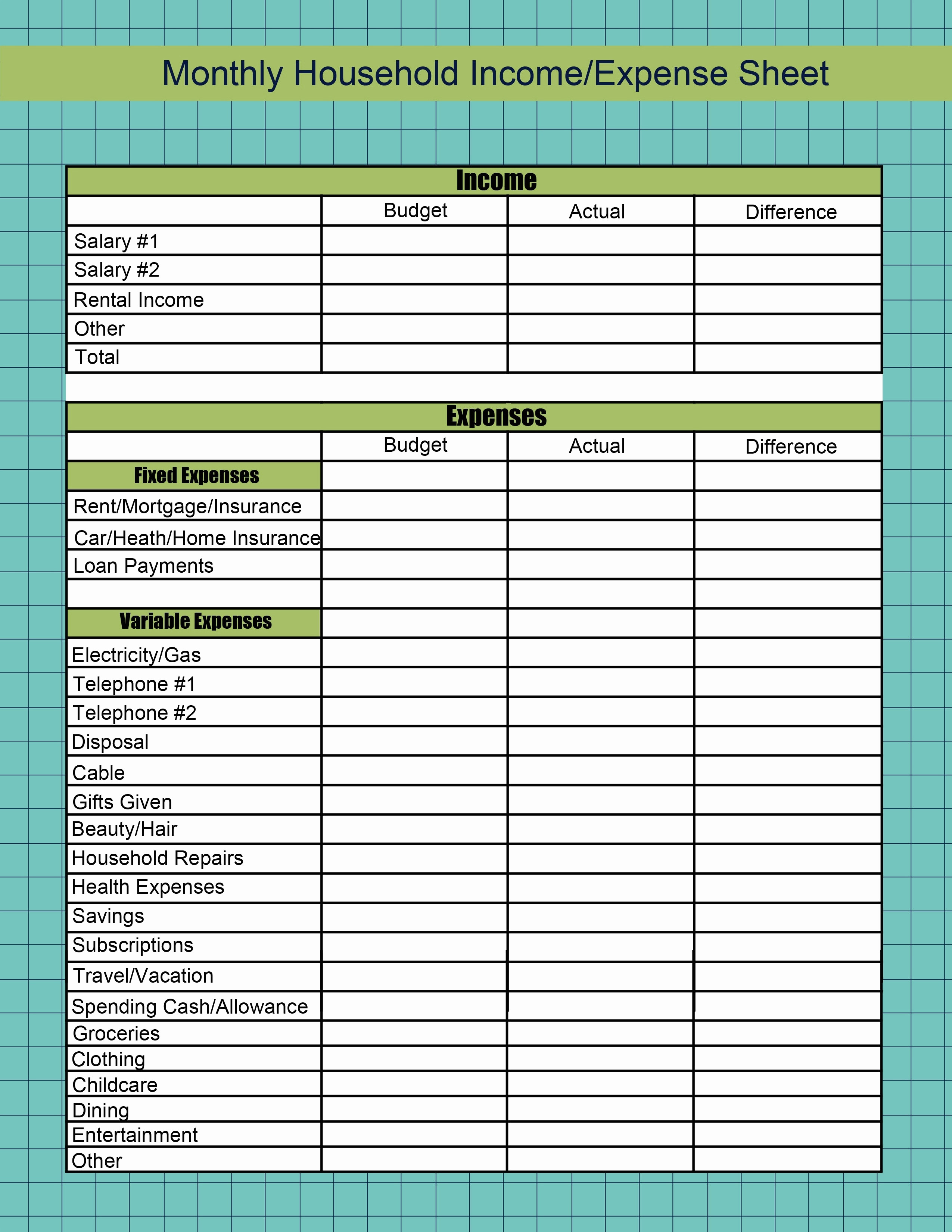

Advanced Net Worth and Expense Tracker Spreadsheet. Intermediate Expense Tracker Spreadsheet with Charts. Expense Tracker Templates for Google Sheets. When it comes to categorizing your expense transactions, you can either do this manually in a couple of minutes each day, or use AutoCat to handle this automatically. Related: How to Choose Your Budget Categories + Suggestions. It’s best to keep everything simple to start you can always add more budget tracking categories later. (However, you can split transactions and use tags – read more here.) Find more suggested budget categories here.Įach transaction can only go in one category. Examples of common expense categories are mortgage/rent, utilities, kids, pets, health, groceries, restaurants, cars, clothing, travel, insurance, and debt repayment. The next step is sorting your expenses in a meaningful way. Learn more → Suggestions for categorizing expenses in your template It’s completely free to try for 30 days, and you keep all data imported during your trial. Read: Getting your financial data into your spreadsheetsĪutomated workflow: Tiller can automatically update your spreadsheets with your daily spending, account balances, and other account balances from banks, credit cards, brokerages, and 21,000 other financial sources. Then you can either cut and paste your transactions into your spreadsheet, or export a CSV file that you can then either import directly into your sheets or again cut and paste data. Manual workflow: Log into your bank website. There are a couple of ways to get your bank and credit card transactions into your spreadsheets: Once amount for each expense is entered, the template will auto-calculate your total expenses.įeel free to add any notes or comments on the template if deemed necessary.How to get transactions from your bank into your expense template Under the expenses column, list down all expenses spent for the month, e.g., rent, groceries, utilities, transportation, etc. Once earnings for each income is entered, the template will auto-calculate your total income. Your income source may be from salary/wage, pension, investment, or others.

Advanced Net Worth and Expense Tracker Spreadsheet. Intermediate Expense Tracker Spreadsheet with Charts. Expense Tracker Templates for Google Sheets. When it comes to categorizing your expense transactions, you can either do this manually in a couple of minutes each day, or use AutoCat to handle this automatically. Related: How to Choose Your Budget Categories + Suggestions. It’s best to keep everything simple to start you can always add more budget tracking categories later. (However, you can split transactions and use tags – read more here.) Find more suggested budget categories here.Įach transaction can only go in one category. Examples of common expense categories are mortgage/rent, utilities, kids, pets, health, groceries, restaurants, cars, clothing, travel, insurance, and debt repayment. The next step is sorting your expenses in a meaningful way. Learn more → Suggestions for categorizing expenses in your template It’s completely free to try for 30 days, and you keep all data imported during your trial. Read: Getting your financial data into your spreadsheetsĪutomated workflow: Tiller can automatically update your spreadsheets with your daily spending, account balances, and other account balances from banks, credit cards, brokerages, and 21,000 other financial sources. Then you can either cut and paste your transactions into your spreadsheet, or export a CSV file that you can then either import directly into your sheets or again cut and paste data. Manual workflow: Log into your bank website. There are a couple of ways to get your bank and credit card transactions into your spreadsheets: Once amount for each expense is entered, the template will auto-calculate your total expenses.įeel free to add any notes or comments on the template if deemed necessary.How to get transactions from your bank into your expense template Under the expenses column, list down all expenses spent for the month, e.g., rent, groceries, utilities, transportation, etc. Once earnings for each income is entered, the template will auto-calculate your total income. Your income source may be from salary/wage, pension, investment, or others.

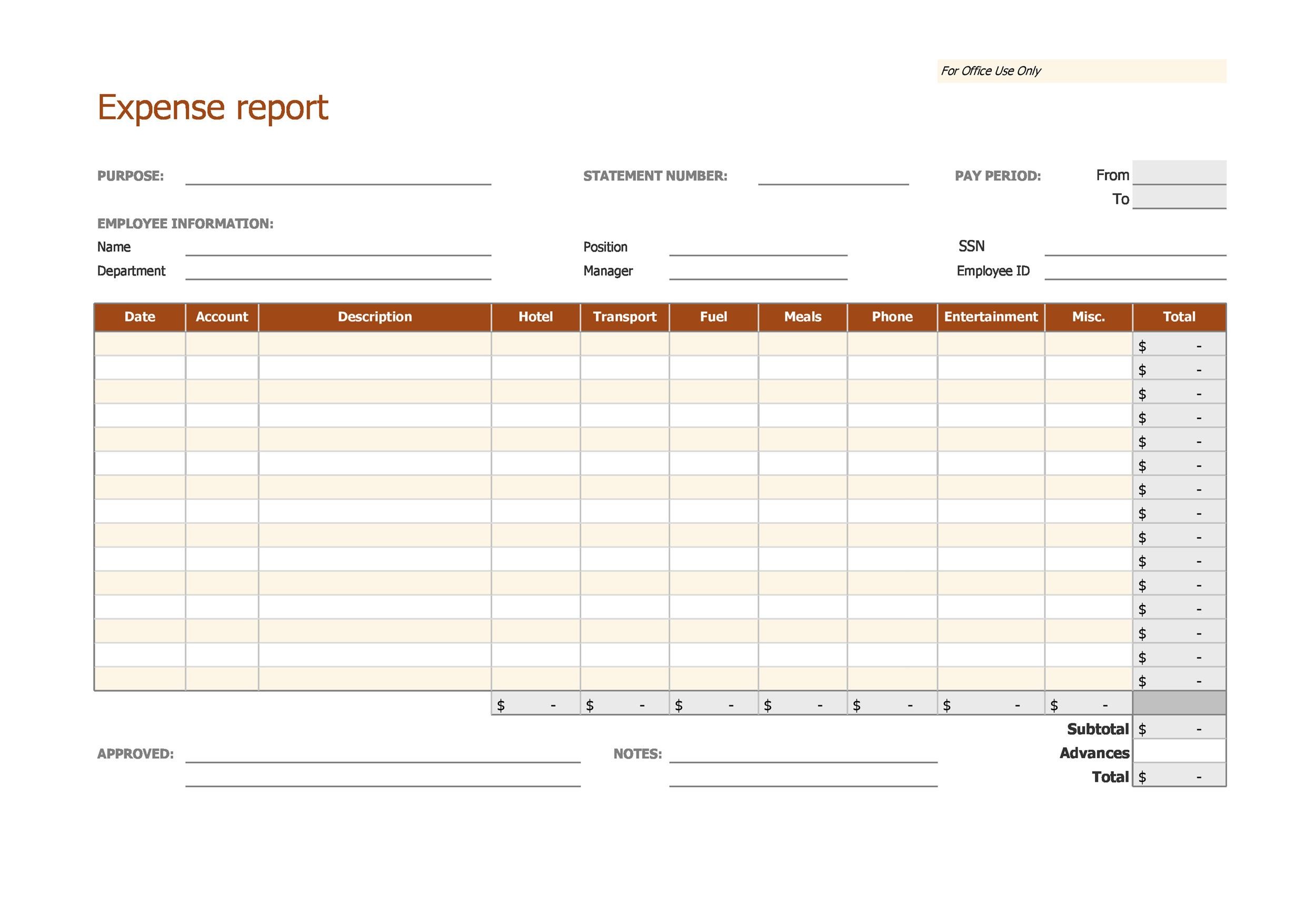

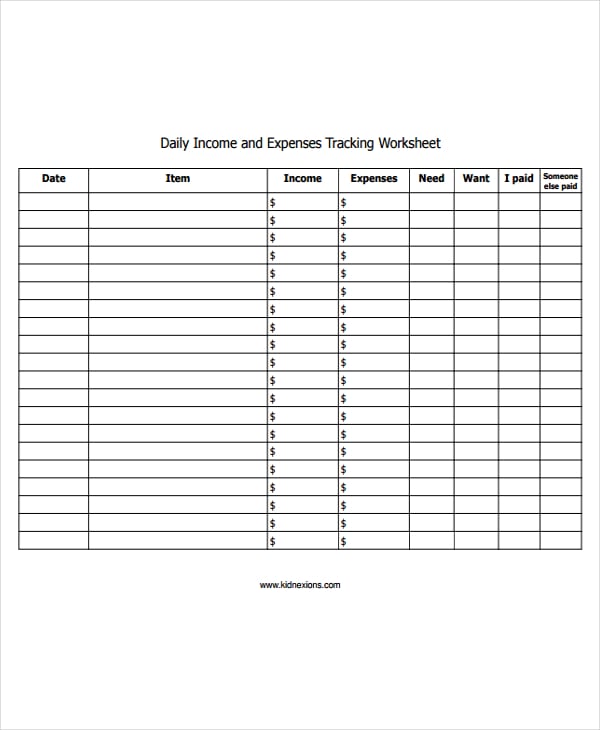

Indicate your source of income along with your specific earnings.Įnter your sources of income under the designated column. It is free to use, print, or download.įor a thorough explanation on how to use this Simple expense tracker, see instructions below. It has sections for the month, date, income source, amount, total income, net income, expense category, total expenses, and notes.Įliminate your wasteful spending habits by using this excel income and expense template. The income and expense sheet is designed with two tables to capture clear data of your income and expenses. This money tracker can give you information on how much you earn and how to best spend your money. Tracking your income and expenses helps you improve your financial habits.

0 kommentar(er)

0 kommentar(er)